MAKE LIFE EASIER WITH CASH SALE

Sell My House Fast for Cash in Charlotte, North Carolina – We’re Ready to Buy

Do you want to sell your house fast in Charlotte? We buy houses fast and want to pay cash for your house.

We’re Zack Buys Houses, and we’re a company that buys houses in any condition and without hassle. If you’re looking for tips to sell your house fast, it makes sense to contact us for a no-obligation cash offer today. We’re a company that buys houses, and we never waste the valuable time of owners with a low offer. We believe selling your house shouldn’t be stressful or time-consuming.

As respected cash home buyers in Charlotte, we strive to support each seller with a fast, transparent offer. Call us today for a fair cash offer and a quicker home sale. Call our home buyers at (704) 769-0141 – we might be an excellent fit for you! You can learn more about Our Cash-Buying Process!

Since we are local, we understand the Charlotte real estate market and assure you a competitive cash offer for your house. Call us TODAY and we can buy your house in just a week!

I needed to sell my quickly home because of a divorce. The 2 real estate agents in Charlotte I spoke with told me I was going to owe money when the house sold because I had very little equity and had to pay all the closing costs and commissions. Zack was able to buy my house and pay all the closing costs so that I could walk away and start over. ~ Samantha P.

BE CONFIDENT WITH US

Top-Rated Company That Buys Homes in Charlotte – Close in Days

Hi there, I am Zack Moorin, founder of Zack Buys Houses. I moved to Charlotte, North Carolina in 2015 to be closer to my family. The Carolinas were a perfect fit for me because I love to be outdoors, enjoy hiking, motorcycling, and being up in the mountains and down at the beach. I’ve been blessed to find my soulmate and wife, Kelly, who is from the area. We’ve settled into a beautiful new section of Steele Creek with my stepson, Jackson, and our rescue dog, Nala, AKA “The Goose”.

As a cash-for-houses company that buys homes like yours, Zack Buys Houses makes it easy to sell your house fast for cash. The sellers we work with appreciate getting a quick offer from us, which allows you to compare your options and decide if a quick cash sale is right for you.

As a company that buys houses in Charlotte, we have an efficient, simple process that makes selling your house easy. In fact, the entire experience of selling to us may take less than a week. You can even choose the closing date!

Sell Your Charlotte House To Cash Home Buyers 95% Quicker

We buy houses in ANY CONDITION. No Hidden Fees or Commissions. Sell Your House As-Is And Close On The Day Of Your Choice. Fill Out The Form Below.

Hi, my name is Doris, and selling my house with Zack Buys Houses was a wonderful experience. I got a very fair price, sold on my timeline, and didn’t have to make any repairs—exactly what I wanted. The process was smooth, and I highly recommend Zack Buys Houses to anyone looking to sell their home.

We Buy In All Situations

Facing a Tough Situation? We Buy Houses in Charlotte Fast

Selling your house quickly to a “we buy houses company” is faster and easier than listing your house for sale through a Realtor. We pay cash for houses, so you won’t contend with financing delays. We won’t do a property inspection or haggle with you over the price. Title issues won’t be a problem. We buy houses from homeowners in a variety of situations, and we are interested in buying your house for cash, too.

Foreclosure

If you’re behind on mortgage payments, facing tax liens? We can help you avoid foreclosure in Charlotte with a quick sale.

Lots Of Repairs?

Making expensive updates before selling your Charlotte property isn’t necessary because we buy houses as is.

Inherited Properties

If you’ve inherited a house in Charlotte and are dealing with probate, a quick sale to us will help you move the probate process along.

Getting Divorced

You don’t have to wait months to sell your Charlotte home and finalize your divorce when you sell your house fast to us for cash.

Job Relocations

If you’re moving to take advantage of an amazing job opportunity and don’t have time to list your Charlotte home. We can help.

Tired Landlords

Dealing with tenants can be exhausting, and you can walk away from your rental Charlotte house quickly with a cash offer from us.

Our home-buying service makes it easy to sell homes as well as other property types. We buy homes as well as land, duplexes, townhouses, condos, mobile homes, and even commercial properties. We’ve helped many homeowners in Charlotte and surrounding areas with their real estate needs, and we’re ready to give you a quote on your home.

We needed to sell our grandma’s house, because she could no longer live on her own. After three generations of birthdays, holidays and countless memories one of the hardest decisions my siblings and I had to make was selling Grandma’s house in Charlotte. Zack was patient and understanding, gave us a fair offer and made the process easy so that our family could sell and move on.

– Linda E.

OUR PROCESS IS SIMPLE

Selling The Simple Way – With Charlotte Cash Home Buyers

You don’t need to make updates or list your house for sale on the MLS through a real estate agent. As a direct buyer serving the local company, Zack Buys Houses has a deep understanding of the Charlotte real estate market. We don’t need to apply for financing either. As a result, you can sell your home faster and easier while getting a fair offer. Just use our three-step process to get a quick cash offer and sell your house fast.

Contact Us!

Tell us a bit about the property that you want to sell.

Get An Offer!

We’ll send you a fair all-cash offer right away.

Get Your Cash!

You’ll get paid quickly when you agree to sell your house.

At Zack Buys Houses, we’re a reputable buyer that will deliver on our promise to buy your house fast, and we’ll give your sale the needed personalized attention. We aren’t flippers or a big corporation that snatches up houses left and right. We’re an experienced and ethical local buyer that can help you sell your house fast. We have deep knowledge of the market in Charlotte and help you get paid quickly. Our personalized approach means that you can get a more competitive offer, sell faster, and avoid the average headaches and delays that come with selling your house.

WHO DO WE HELP?

We Buy Houses for Cash in Charlotte, North Carolina – Any Condition

As professional home buyers who pay cash for homes like yours in Charlotte and other nearby cities, we offer several benefits over selling your house through real estate agents.

No Realtor Fees

Realtor fees, commissions, and closing costs can cost a small fortune, and these expenses are unnecessary. As a direct homebuyer, we’ll give you a fast offer without the need for agents. In the process, you’ll save a ton of money and sell faster. Getting your home sold won’t cost a fortune when you sell your house fast to us.

No Open Houses/ Private Home Sale

Whether you try to find a homebuyer through an agent or by listing the property for sale as an FSBO, you’ll need to make your property accessible to potential buyers with open houses and showings. However, we’re a direct cash buyer and buy homes as-is in Charlotte. You’ll bypass the many headaches associated with finding a buyer when you sell your house fast to us.

No Stress

As a real estate investor, we’ll handle all the repair, painting, and other tasks on your to-do list after the sale. We buy houses as-is in Charlotte, so you don’t have to contend with the time and hassles of hiring contractors. More than that, we don’t need to finance the property so that you can enjoy a stress-free, fast sales process.

SELLING MADE SIMPLE

Sell Your Charlotte Home AS-IS – Any Condition, Any Reason

As investors, we present a superior way to sell your house quickly. We buy houses and other property types in Charlotte in all conditions and across the area. What can you expect when you sell your house in Charlotte, North Carolina, directly to us for cash?

No Commissions Or Fees

As investors, we buy houses directly. You won’t need to hire a real estate agent and pay thousands of dollars in unnecessary fees and commissions when you sell your house. We’ll make you a fair offer upfront, so there’s no need to negotiate either.

Competitive Cash Offers

Do you already have an offer from a “we buy houses” company in Charlotte? Give us the information, and we’ll beat that offer. More than that, we’ll answer your questions and tell you why our offer makes sense for both parties. We won’t ever lowball you or waste your valuable time.

Close When You Want

Timing is important when you sell your house for cash. When you accept our offer to purchase your Charlotte house, you can choose the closing date. You could close in a week or less because we don’t need to order a property inspection or apply for a loan.

Fast Sale

You understandably need a fast sale whether you’re getting divorced, stuck in probate, or dealing with other issues. We won’t slow you down with negotiations, repair requests, third-party reports, or financing. We can close in as little as seven days.

Private Home Sale

You don’t have to endure a seemingly endless stream of potential buyers walking through your Charlotte house to sell it. Because we are the buyer, you can enjoy the many benefits of a private home sale. This includes privacy, lower costs, and greater control.

No Repairs Needed

We want to buy your house as is. When you sell your Charlotte house to us, you don’t need to paint the walls, replace the carpet, or even clean out the junk. Regardless of its condition, we want to buy your house for cash today.

FAST SALE, NO REPAIRS!

Cash For My House Charlotte North Carolina

You can sell your house for cash and bypass the headaches of a traditional sale. You don’t have to hire a real estate agent or pay agent fees. No cleaning or repairs are required. You won’t deal with rehabbing, related expenses, open houses, or other hassles. That sounds great, right?

Zack Buys Houses knows that selling a house can be stressful, and we don’t want to add to your busy life. Selling your home doesn’t have to be complicated and hectic. We proudly offer you a simplified selling process in Charlotte. We’ll help you get paid for your house fast and without unnecessary hassles. We buy houses, and we’re interested in your property. To learn more and to request an offer, fill out our form today.

You simply agree to our cash offer and schedule your closing date. We will buy your Charlotte property fast, with cash, and we’ll take care of the headache.

WHAT ADVANTAGES?

What Are The Pros and Cons of an All Cash Offer In Charlotte North Carolina?

Advantage #1: Low Risk Of The Deal Falling Apart

Approximately 4% to 5% of real estate transactions successfully close. In February 2024, the number of listings that remained unsold rose by 10.3% compared to February 2023. When you accept a cash offer from us, you don’t have to worry about your property staying up for sale for too long or about the sale falling apart after you find a buyer.

Many buyers use financing from banks or lending institutions to complete their purchases. This requirement for third-party approval creates an added risk of not closing. We pay cash when we buy houses, so we always close on our transactions.

Advantage #2: Speedy Sale

The real estate financing process in Charlotte takes several weeks or longer. With a cash transaction, there are no financing delays. As a result, a cash sale is often completed within a matter of days rather than months.

Advantage #3: Fast Cash

A cash offer is your best bet to sell your house if you need to close fast, such as if you’re going through a divorce or dealing with the loss of your job. When you sell to cash buyers like us, you can get cash for your home and eliminate your current mortgage payment from your budget.

Advantage #4: Avoid Formal Inspections and Appraisals

During a traditional sale, a property inspection and a home appraisal are commonly ordered. These reports can take days or longer to complete, and they might lead to additional negotiations. We buy houses in Charlotte without an appraisal or an inspection, and we won’t try to renegotiate our offer.

For sellers who want to sell their house quickly and benefit from a smooth transaction, the speed, reliability, and convenience of a cash offer are important considerations. There won’t be fees or holding costs, such as for property insurance and taxes.

Zack Buys Houses is experienced in Charlotte North Carolina, and we’re ready to give you a fast and fair offer. To get started, fill out our short form!

Sell Your Home Fast For Cash Money 💰

Con #1: You Might Get A Lower Sale Price

A cash offer eliminates uncertainties and makes the sales process faster and easier. Owners are often willing to accept a lower offer to sell quickly and enjoy an easier process. In fact, according to the University of California, San Diego, all-cash buyers often pay 10% less on average than buyers who use a mortgage.

Con #2: You Might Pay High Hidden Costs

Unfortunately, some other cash buyers and national buying companies charge hidden fees, which may inflate the cost of the sale by 13% of the sales price in Charlotte. However, Zack Buys Houses does not charge these fees. We are completely transparent, so you are assured of getting paid based on the offer that you agree to when you sell quickly to us.

With both pros and cons to consider, selling your house quickly for cash isn’t the right option for everyone. Our previous clients have decided that the speed and convenience of a quick cash sale or the ability to sell without making repairs are advantageous. Zack Buys Houses will give you the highest cash offer possible, and our offers come with no obligation. Request a cash offer for your Charlotte home today.

We Bought Their Charlotte NC Home, And We Can Buy Yours Too!

Sell Your House In Charlotte Without An Agent

You don’t need a real estate agent to sell your home! We are not Realtors or brokers looking for listings—we’re cash home buyers in Charlotte ready to make you a fair offer. If you need to sell your house fast, we provide a hassle-free solution with no commissions, no repairs, and no stress!

Skip the hassle of listing and sell your home directly to us! Maybe you’ve tried selling FSBO but ran into challenges, or buyer’s agents have approached you with marketing offers. The traditional selling process isn’t always the best fit, and we’re here to offer a faster, easier alternative.

| SOLD to Zack Buys Houses | Selling with A Real Estate Buyer | |

|---|---|---|

| Commissions / Fees: | NONE – Sell For Free | Yes, the sale is often subject to lender approval |

| Who Pays Closing Costs?: | NONE – We pay all costs | 2% on average is paid by the seller |

| Mortgage Financing: | NONE – We make cash offers | Yes, the sale often subject to lender approval |

| Appraisal Needed: | NONE – Sell without appraisals | Yes, the sale is often subject to appraisal |

| Showings or Open House: | NONE – Sell without open houses | Daily/Weekly |

| Closing Date: | Sell On The Day of YOUR CHOICE | 30-60 +/- days after accepting the buyer’s offer |

| Who Pays For Repairs?: | NONE – We pay for all repairs | Negotiated before closing |

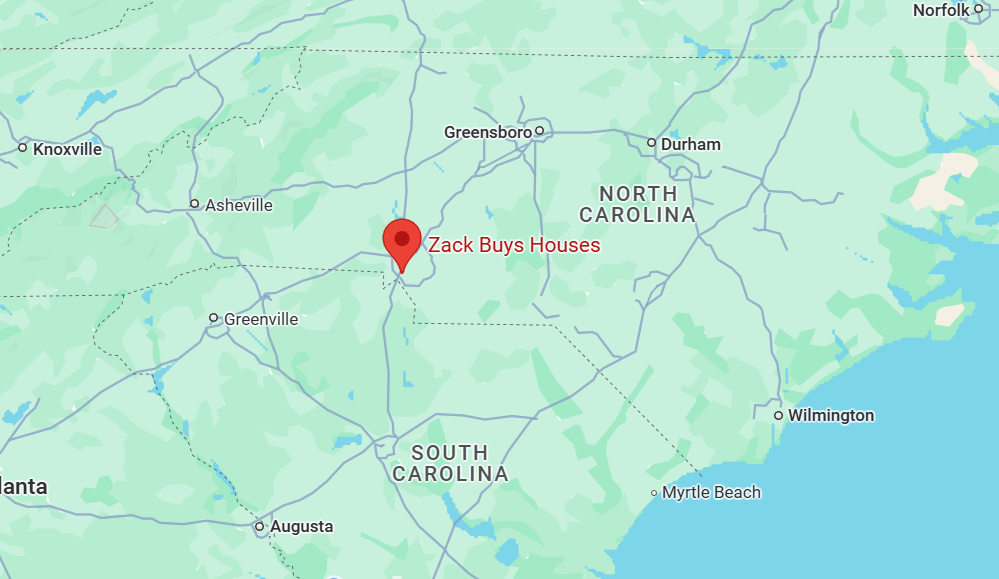

Where We Buy Houses in NC

As your trusted cash for homes company in North Carolina, we also serve owners in other nearby areas. This includes Charlotte, Greensboro, Winston-Salem, High Point, Concord and Kannapolis. As real estate investors, we buy houses just like yours using our own funds. This makes getting your home sold a faster and easier experience.

We will give you a fair cash offer on your house. It’s that easy. If you already have moving plans or need a quick infusion of cash to put a down payment on your next place, an all-cash sale is perfect

Sell Your Home Charlotte

• North Carolina

• Asheville, NC

• Boone, NC

• Lenoir, NC

• Morganton, NC

• Hendersonville, NC

• Newton, NC

• Waynesville, NC

• Marion, NC

• Shelby, NC

• Kings Mountain, NC

• Pineville, NC

• Mooresville, NC

• Cornelius, NC

Buy My House Charlotte

• Thomasville, NC

• Lexington, NC

• Reidsville, NC

• Burlington, NC

• Mebane, NC

• Asheboro, NC

• Cherryville, NC

• Rutherfordton, NC

• Maggie Valley, NC

• Lincolnton, NC

• Harrisburg, NC

• Stallings, NC

• Belmont, NC

• Mint Hill, NC

Sell My Home Charlotte

• Mount Holly, NC

• Charlotte, NC

• Greensboro, NC

• Winston-Salem, NC

• High Point, NC

• Concord, NC

• Gastonia, NC

• Huntersville, NC

• Kannapolis, NC

• Hickory, NC

• Indian Trail, NC

• Monroe, NC

• Matthews, NC

• Statesville, NC

• Salisbury, NC

Why Zack Buys Houses Loves Investing in the Charlotte Real Estate Market

Zack Buys Houses is drawn to the Charlotte real estate market because of its rapid growth and strong economic foundation. As one of the fastest-growing cities in the Southeast, Charlotte offers a steady demand for housing fueled by new residents, thriving industries, and expanding job opportunities. This consistent activity creates ideal conditions for helping homeowners sell quickly and easily.

Charlotte‘s mix of older homes, fixer-uppers, and developing neighborhoods makes it an excellent fit for Zack’s investment model. Whether it’s a property needing significant repairs or a house that won’t sell on the open market, Zack Buys Houses is ready to provide fair cash offers with no hidden fees or delays. It’s a win for sellers who want a fast, stress-free sale.

The city’s ongoing development in areas like NoDa, West End, and South End shows strong potential for long-term value. Zack Buys Houses sees an opportunity to make smart investments and contribute to neighborhood improvements that benefit the entire community. With each purchase, the focus is on adding value and creating a positive impact.

Charlotte homeowners value honesty, speed, and simplicity, which Zack Buys Houses brings to every transaction. Whether someone faces foreclosure, moving out of state, or dealing with an inherited home, Zack provides a reliable solution tailored to their needs. This people-first approach makes investing in Charlotte both rewarding and meaningful.

Helpful Charlotte Blog Articles

- Selling Your Charlotte Home After A Few Years

- Optimal Seasons For Selling A Home In Charlotte, NC

- Navigating a Reverse Mortgage Sale in Charlotte, NC

- Selling A Mold-affected House In Charlotte, NC

- Comprehensive Guide To Replumbing Your Charlotte Home

- Selling A Water-Damaged House In Charlotte, NC

- Selling Inherited Property In Charlotte, North Carolina

- Selling Your Duplex In Charlotte, NC Quickly And Profitably

- Selling Jointly Owned Real Estate In Charlotte, NC

- Selling Inherited Property In Charlotte, North Carolina

Cash Home Sales in Charlotte: Frequently Asked Questions

Thinking about selling your house for cash in Charlotte? Whether you’re behind on payments, relocating, or just want a faster sale, cash buyers can offer a quick and stress-free solution. Below, we answer the most frequently asked questions from homeowners just like you—so you can feel confident and informed every step of the way.

How do I know if my cash offer is legit?

The unfortunate reality is that not everyone interested in buying your house is legit. We have a great reputation in the community and have helped many sellers like you with our fast “cash for homes” process in Charlotte. When your offer is from Zack Buys Houses, you are assured it is legit.

Are there any contingencies in the buyer’s contract?

When you sell your house traditionally, the sales contract will likely be riddled with contingencies. Financing, inspection, and more are common contingencies that allow the buyer to back out of the deal. We buy houses for cash in Charlotte without contingencies, so we can close without unexpected delays.

Is the buyer real, or are they trying to wholesale the property?

We buy houses directly, and we aren’t a wholesaler. A wholesaler is a middleman who makes a profit by reselling a property to an investor. Because we are investors in Charlotte, you won’t be working with a middleman.

Do they put down a decent earnest money deposit?

Zack Buys Houses is serious about buying your property, so you can expect us to provide a healthy earnest money deposit. The deposit is $5,000 or more when we buy houses, depending on the circumstances.

What is the fastest way to sell a house?

The fastest way to sell a house is with a cash buyer. When you sell your Charlotte house fast to a cash buyer, you won’t deal with financing delays, intermediaries like real estate agents, third-party report delays, and other issues. As a cash buyer, we can buy your house in as little as seven days.

Do they actually come out to view the property?

Often, ibuyers and national real estate companies make a great offer upfront, but then they inspect the property and find a reason to reduce their offer. We don’t use this common bait and switch tactic. We’ll make an offer after we review your house in Charlotte, and we won’t renegotiate or back out of the offer.

Are companies that offer cash on a house legit?

Many, but not all, companies that offer cash to buy your house are legitimate. Before accepting an offer, you should always research a “cash for houses in Charlotte” company upfront. You can do so by reading reviews from several different online sources.

Please Contact Us or head over to the Frequently Asked Question section if you haven’t find answers to your questions about selling your house in Charlotte.

We can provide tips and suggestions about tax, equity, cash payments, Our Company, and How We Buy Houses, etc.

we buy houses Charlotte sell my house fast Charlotte cash home buyers Charlotte cash for homes Charlotte

How to Sell Your Charlotte House the Easy Way – No Stress, Just Cash

A cash offer from Zack Buys Houses is a fast, hassle-free way to sell your house. We buy homes directly from owners like you regardless of their condition, and we make it easy to get your house sold fast. If you have questions or want a fast, no-obligation offer, contact us online or by phone today.

Skip the Agent Fees – Sell Your Home in Charlotte NC Fast for Cash

We buy homes in Charlotte in AS-IS CONDITION. No Hidden Fees or Commissions. Sell Your House As-Is And Close On The Day You Choose. Fill Out The Form Today.

| real estate solutions | someone who buys homes |

| anywhere | business |

| home buyer | solution |

| real estate investors | handle everything |

| death of a loved one | cash home buying company |

| home buying company | rental property |

| home selling process | listing process |

| sell Charlotte home | problem solvers |

| selling experience | we buy houses Charlotte without commission |

| your North Carolina home | people who buy houses |

| people that buy houses | Charlotte NC |

| sell my house fast | properties | fair cash offer | cash offers | home | 2024 |

| fast offer | house sell | properties | our house | sell my house fast in | sell house |

| we buy homes | cash for homes | Sell Your House | home selling | cash for properties | sell buyer |

| cash buyer | fast cash buyer | buyer | COMPETITIVE MARKET | sell properties | sell property |

| faster | cash buyers | house buying | ibuyers | investors | sell MLS |

| real estate investors | sell | HOMEOWNER INSURANCE | HOMEOWNER’S INSURANCE | FLAT FEE MLS | FLAT-FEE MLS |

| sell | U.S. | TRANSFER FEES | cash offer | fair | EXCISE TAX |

| NEGOTIATION | INTEREST RATE | EARNEST MONEY | PRICE | FOR SALE BY OWNER | CALCULATOR |

| TITLE COMPANIES | REAL PROPERTY | HOME APPRAISAL | FSBO | FLAT FEE | SELLER’S MARKET |

| sell Charlotte home | home’s sale | sellers | sale | fair market | sale hassles |

| avoid traditional | we buy houses in Charlotte | sell your home quickly | 1 | one | sell fast |

| your North Carolina home | Home Buyer | we buy homes | buy house | zillow | sell |

| opendoor | offerpad | homelight | homevestors | real estate agents | home fast |

| cash fast | agent | home buy | reasons to work with Zack Buys Houses | one | we buy houses |

| one percent listing | your home | sell your home fast |

Call us at (704) 769-0141

Call us at (704) 769-0141